This text and the questions that follow were delivered during my conference on 6 February 2012 at the Institut de France in response to the invitation of the Académie des Sciences Morales et Politiques.

———————————————————–

Natural resources are a source of industrial dynamism for producing countries, while consuming countries have entered into competitive consumption.

That is why I propose, without delay, to review what I believe a national doctrine on mineral raw materials should be before discussing a scenario related to German energy policy.

Three elements form the basis of a national commodity doctrine: energy independence, food self-sufficiency and mineral independence. The absence of one of them prevents sustainable economic development.

1 National Commodities Doctrine

Definition

For metals, this doctrine is based on a thesis that will be active (Asia) or passive (Europe):

Japan and Korea are seeking a stable supply for the country’s economy.

China seeks to maintain a stable domestic supply through centralization of needs, industrial consolidation and less smuggling.

The United States is seeking to diversify supplies, substitute and recycle to industrialize.

Europe is seeking to avoid a shortage.

Naturally, a producing country, Australia or Canada, will encourage investment to maximize income.

Countries importing natural resources will implement a doctrine using several tools: a precise definition of materials, dynamic mining companies, privileged partnerships with producer states, strategic stocks, public or private trading companies in charge of national supply.

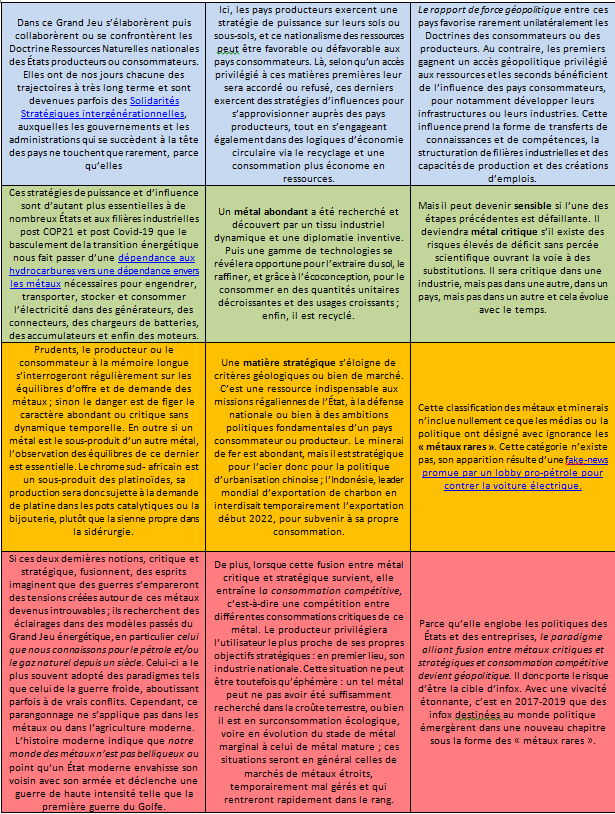

a) What is a critical commodity ? It is a resource for which the industrial risks associated with a supply shortage are high and for which there is no possible substitution. A subject will be critical in one industry but not in another, in one country but not in another and this evolves over time.

b) What is a strategic commodity ? It is an indispensable resource for state policy or national defense. Here again, a subject will be strategic in one country, but not in another, and this evolves over time.

At European level I cannot find a common policy or common defence that would justify this list. China, the USA, Korea and Japan have a list of strategic metals.

In the wrong order, these materials are: copper, nickel, iron, coal, platinum, palladium, rhodium, rhenium, antimony, beryllium, cobalt (solo, nickel, copper), gallium (bauxite and zinc), germanium, graphite, indium (zinc), magnesium, niobium, rare earths (cerium, lanthanum, neodymium, terbium, europium, yttrium, terbium, lutetium…) tantalum, tungsten, lithium, tellurium, etc.

Update from: Rare metals do not exist, it was a fake from pro-oil

c) Which industries consume these materials?

We were all familiar with the slow contagion model for steel consumption, from the construction of the Eiffel Tower to the towers of Chinese cities. Here, for these materials, we are witnessing a galloping epidemic. It’s unique. Everyone wants it for everything and at the same time: in electric cars, new aircraft models, light-emitting diodes, electronic chips, smart phones, OLED screens, solar panels, wind turbines, electricity storage, fuel cells, national defence, steel, optics, lasers, petrochemicals, nuclear, etc.

The example of rare earth-based permanent magnets illustrates this growing consumption. Composed mainly of neodymium, dysprosium and praseodymium, their demands were a few grams in computers, but now they are 200 grams for an electric bicycle, 1-2 kg for an electric car and nearly 200 kg/MW for direct drive wind turbines.

We will understand this immediately, these consumptions will be in competition with each other and it is the producer of raw materials who will direct the flows according to price criteria – the different criticalities will be in competition – or strategic notions of the producing states.

These choices will be safe if you have to choose between a phone or a computer that also makes a phone. But what to do when it comes to choosing between energy production dependent on strategic metals, or if there is a national security dimension?

(d) Why does the supply of critical metals not immediately meet demand?

In production forecasts, simplistic reasoning accounts for the resources available in the earth’s crust without regard to the economic reserves to be discovered or extraction models. Although sometimes these metals are not unobtainable, they are co-products of other major metals and some of these production chains are opaque. Thus, there is no indium mine but zinc, tellurium but copper, molybdenum but copper, gallium but bauxite, rhodium but nickel or platinum. Of course, these metals are dependent on the dynamics of the major metal, they are not profitable in themselves and, if they are not produced for technical reasons, it may be for economic reasons.

Sometimes the mines of major metals are insufficient, or at the end of their life, and mining renewal has not been prepared: future new deposits have not been sought, so not yet discovered, a mine is 10-20 years of work before production, but some countries refuse to open mines.

Recycling these metals in the industrial cycle is the simplest step. Then, a wait of sometimes 20 years will precede the recycling of the carrier products. Moreover, on the latter, the deposits of materials are sometimes so thin, the alloys so complex or the contents so low, or even all at once, that we will not be able to recover them well. Recycling alone will therefore not satisfy consumer needs.

2) Tools to address deficits

(a) The mining industry

The dynamism of energy and mining companies is measured through their investments in the exploration and/or acquisition of new deposits. The French mining industry is a disappointment. For lack of vision, she remained prostrate, small and frozen while mining giants were being born elsewhere. This week two companies that did not exist twenty years ago, Glencore and Xstrata, announced a $90 billion merger while our older mining companies are thirty times smaller. In addition, our mining projects are less dynamic.

A new starting point on our territory would still be possible. The opening of small mines by innovative exploration SMEs in the Pyrenees, the Massif Central and Brittany for copper, zinc and tin from tungsten would allow the modern production of “strategic metals” co-products while respecting the environment.

Moreover, with the exception of coalfields, the French geological horizon is not known below 100 metres. The KGHM copper mine in Poland is 1000-1200 metres away, the Las Cruces copper mine in Spain is under a 150 m waste rock, the Neves-Corvo copper and zinc mine in Portugal is 700 metres away. In the rest of the world, mines commonly reach 1000-2000 metres, or even 4000 metres in South Africa. In France, the geological context of Brittany, the Massif Central and the Vosges is favourable, a deep exploration of the subsoil has the potential to lead us to discover more important deposits.

For small mines, a first step can represent 5,000 direct jobs, while the second step can represent large deposits, twice as many for each discovery. There is a factor 5 between direct and indirect employment.

But it takes courage because the question of prospecting arises: the abandonment of exploration for oil and shale gas in France, and its potential of hundreds of thousands of jobs with indirect jobs, questions us.

The first obstacle to prospecting in France is that today we no longer listen to the engineer’s words. The second is administrative: the new Mining Code will adopt the principle of public inquiries from the Environment Code, but these innovations have not yet been formalised. In addition, mining activity is isolated in the Ministry of the Environment and not integrated into the Ministry of Industry. Finally, the Regional Directorates of Environment, Development and Housing, which receive mining applications, are no longer trained in this activity. This loss of technical skills complicates the processing of cases. Indeed, the generation of geologists, miners and energy experts of the 1950s and 1960s who had the knowledge because they had exploited what could be exploited in France, before gaining territories abroad, is no longer in activity; the next generation leaving the formations is not yet in function. This is why French geology students are looking for a professional dynamic in foreign mining companies, or even in large metal-consuming industrialists who wish to complete their skills.

Need we to remind you that the industrial cycle is: exploration, exploitation and transformation of natural resources, then industrial manufacturing, marketing, then service and finally recycling. Are we prepared for mining jobs in France for products made in France? It should be recalled that the industrial model of the consumer products of global nomadic electronics was largely built on the extraction, disrespectful of the environment, of Chinese rare earths (97% of production, 49% of known reserves). In this context, it is difficult to blame the Chinese authorities for putting their house in order despite the spread of a ridiculous anti-Chinese conspiracy and hysteria. Indeed, we should be able to do things differently with local products that are immediately environmentally friendly.

Let’s summarize this first idea in one question: Why does Mongolia know a mining El Dorado and not France?

(b) Privileged partnerships between producer and consumer States

Producers are sovereign over a soil or subsoil and exercise power strategies.

Consumers are sovereign over industrial sectors and the associated influence strategies. In the future, producers of metals, agricultural products and energy will export less and consume more locally. The latter idea, resource nationalism, is illustrated in a short article with the provocative title: “When the African consumer wakes up China will tremble” (and International and Strategic Review N°84 winter 2011)

And, if producers consume more, we must find a strategic depth. We will come back to this in conclusion.

(c) Strategic stocks

They are a fragile offer for several reasons. This is a temporary proposal, which cannot be shared, requiring a significant investment and permanent dialogue between administrations and companies. They are set up for the long term, but their managers have a duty to navigate on sight, anticipating a market environment where speculation reigns because of their raison d’être. Experienced professionals are needed to ensure this management.

Who has stocks? China, Japan, South Korea, the United States, but also States in the Middle East or Asia for food….

France had built up a strategic stock of metals, but it was sold off in the last decade of the twentieth century. It is said that rules of engagement were forgotten and market-based procurement was one of the peace dividends after the fall of the Berlin Wall. The economic war had not been anticipated.

(d) Public or private trading companies

The trading companies in charge of national supply offer the benefits of an invasion without military war, it is economic war. In this field of metallurgy and trading, France has suffered a recent and serious handicap since the astonishing, mysterious and sudden disappearance of the factories, jobs and metals of its leader, the Comptoir Lyon-Alemand-Louyot after 200 years of existence.

When these few simple concepts are ignored, misused or misinterpreted, industrial sectors complain of mineral shortages when they are forced to rush together towards the same solutions without worrying about mining supply.

3.German energy policy

In my presentation, we come to the scenario that I would like to explore quickly: German energy policy. I am well aware that simplification has its imperfections, but this is the way to illustrate some ideas in such a short time.

In 2011, Germany has about 102 GW of installed capacity and an electricity mix of 58% carbon (lignite, coal, gas), 20% renewable energy and 21% nuclear. By 2022, it plans to close its 21 nuclear power plants, while reducing consumption and increasing the share of coal, gas and also renewable energies (35%), in particular wind power.

The film of the last few weeks is instructive in this respect.

This winter, the world leader in the manufacture of wind turbines is in financial difficulty, laying off 10% of its global employees: bad weather at sea prevented it from installing as many wind turbines as it wanted, government subsidies have sometimes disappeared, the situation is difficult.

In the future, overpowered wind turbines will be in the majority: in 2009, 60% of wind turbines were less than 2 MW; in 2012, 70% are above 2MW. Large offshore wind turbines are in full development and each one uses rare earths that allow compact nacelles and reduced maintenance.

Germany is becoming aware of its dependence on critical metals and, last year, a junior mining explorer was formed by major German groups to discover and reserve future deposits of three elements (rare earths, tungsten, coal coke). The German government will finance mining exploration, but the companies will be responsible for the exploitation.

Two questions are necessary:

How to manage offshore wind turbine troubleshooting in winter storms? What will it cost? At 35% renewable energy, we are in the electrical tape and no longer in lace.

Will the German junior face the nationalism of the natural resources of the countries it will prospect?

Two ideas open two discussions.

In the minds of some, electric cars, wind turbines or solar panels mean partial or total independence from uranium, coal, oil or gas. But they do not realize that they are becoming dependent on lithium, indium, gallium, rare earths, etc. These are indeed new dependencies that are still poorly understood, or even for some unknown people.

Secondly, I would like to ask a question – and I will be told if it makes sense – to be said slowly and to meditate at length: is it a riskier energy policy than nuclear energy to base its economic development on renewable energies that are still immature, particularly wind power, with meteorological models that are becoming obsolete as the climate changes?

One answer is obviously the rejection of the bipolar – with or without nuclear power, with or without renewable energy – and the acceptance of the multipolar: renewable energy must progress, especially solar energy, and the atom retains a future that is in the atom itself.

Conclusion

If there were only two elements to remember from my speech, they would be independence and access to resources.

If French consumption of critical metals increases, France will have to gain independence, take charge and open mines on its territory.

The mining sector of tomorrow will be new exploration campaigns, lower grades, rising costs due to increased energy and water consumption, and stricter environmental regulations. In France, we have energy, water, infrastructure and ecology. In our country, mines will be mainly jobs, they will be deep, non-polluting and they will propose a solution to the renewal of the industry.

If French mines are insufficient, resources will have to be accessed at a new geological depth. In other words, a territory without demographic tension, depopulated, with raw materials and whose access conditions we would accept. I see only one of them: Russia. This is the subject of a short article “Russia and critical issues” (Revue Géoéconomie N°59 autumn 2011) where I cross my knowledge of natural resources and my political understanding of Russia.

Finally, the concept of nation is embodied if statesmen decide on mineral, agricultural and energy dependencies or independence that are fair in price and availability for populations, whether urban or rural.

Let us not be afraid to choose our independence and our dependence on natural resources, freely and rightly.

Questions from academicians

Marianne Bastid-Bruguière: You told us that the geological horizon in France is at a depth of one hundred meters at most. Do we really have no idea where deposits of these strategic metals and rare earths that we need so much could be found? How do you explain the shrinking of the French mining industry? And when did it start? You mentioned a generational problem and an image problem. Do you feel that the education provided today is distracting engineers from mineral exploration? What is the situation in other countries?

Answers:As far as the geological horizon is concerned, an inventory was made by the Bureau de recherches géologiques et minières (BRGM) in the 1970s. However, this inventory, on the one hand, did not go beyond a certain depth and, on the other hand, was not exhaustive, moreover it focused on the first discoveries and was never the object of a complete and scientific synthesis. However, it is not surprising that the same BRGM has, for example, discovered the Neves-Corvo mine in Portugal or the Yanacocha mine in Peru and that at the time no French company wanted to acquire them to build a French mining group like the oil companies. This remark is already worth answering your second question. The mining industry in France does not have the same dynamism as abroad. There is no Ministry of Mines in France. A student geologist who comes out of ENAG Orléans, ENSG Nancy or the Lasalle Beauvais Polytechnic Institute risks inactivity in our country, whereas in Australia or Mongolia, to give just two examples, he would have about ten job offers, because, first, there are mining giants there, second, these giants have not confined themselves within the borders of their own country and third, the offers are pragmatic. These groups own and operate mines all over the world. I’ve already mentioned Glencore and Xstrata; they are companies based in Switzerland, but as far as I know, there are no major mining deposits in Switzerland. Do we have a problem of generation and image? In Germinal , a mining engineer, says that he learned at the School to calculate the resistance of materials and that therefore for such and such a gallery, etc., he has a problem of generation and image. Today, mining engineers are mainly involved in finance.

Georges-Henri Soutou: Even before the First World War, the Germans, who had no raw materials in Germany, except for coal, had founded Metallgesellschaft in Frankfurt, the purpose of which was not to acquire mines, but to trade by playing on the markets in order to prevent the City of London from setting prices alone. The Allies were well aware of the power of the Metallgesellschaftsschaft and a large part of the measures taken in the economic war against Germany was to prevent Germany from gaining access to raw materials once the military war was over. There was therefore a clear awareness at the time of the industrial, economic and strategic stakes involved in gaining access to raw materials. But very quickly, in France – and not in Japan, the United States or other countries – the mining sector was no longer considered as important as it had been before and was allowed to decline little by little. With the exploitation of new deposits, isn’t it the same phenomenon as with oil, that any discovery of new deposits lowers prices and therefore reduces the incentive to search for new deposits? Most recently, Malaysia opened a rare metals refinery, which accounts for about one-third of China’s production and which may well drive down prices and discourage exploration efforts. Is it possible to imagine, in the current legal and regulatory framework of the European Union, which is very hostile to cartels, a return to either national or European policies on strategic raw materials?

Answer:Do new deposits drive down prices? You take the example of the Lynas plant in Malaysia, which is a rare earths plant. The world production of the seventeen listed rare earths is about 120,000 tons. Lynas will add 3000 or 4000 tons in the first year, then gradually increase to 20,000 tons, but in several years. So this is not what will bring down the prices,because these quantities are already reserved by long-term contracts for new uses,especially in Japan and Germany. This is also true for other metals; for example, in the next 40 years we will consume as much copper as we have consumed in the last 3000 years. In addition, we must take into account the fact that environmental protection and safety measures, which are gradually becoming necessary everywhere, make it much more expensive to open any new plant than in the past. These costs are, of course, passed on in the selling price, and this shows that a new mine does not necessarily lead to lower costs, quite the contrary. An illustration of this is the curves of metal prices as financial crises unfold. Copper, for example, was $1,500 per tonne in 2003; it rose to nearly $9,000 in 2008, then fell back to $3,000 at the height of the crisis in 2009. It rose to nearly $8,000 in 2010, then fell back to a level close to $6,000; finally, it rose to $10,000 in early 2011 before returning to around $7,000 in the fall of 2011. And, currently, the price is rising again. The lows are getting higher and higher, the 2011 low is four times higher than the 2005 low and more than twice as high as the 2008 low. Regarding your comment on the Metallgesellschaft, I would like to remind you that in France, at that time, there was still a mining metallurgical industry worthy of the name, with companies such as Pennaroya. It is unfortunate that Pennaroya gave up deposits to Rio Tinto, the third largest mining company in the world today, which took off even further when it bought out assets held by a French mining company! Going further back in time, it appears that the first company to have had platinum mines in Russia, under the Tsar and then under the Revolution, was the Compagnie Industrielle du Platine, a French company incorporated in Paris in 1898, which I found in Moscow in the archives of the Russian Federation administration. You ask me about the European regulations hostile to cartels.

In this regard, let me say that the Germans have implemented an excellent idea that they had already had in the 1970s. They had formed an alliance between different copper-consuming companies to discover new deposits and exploit them to cover their needs. Instead of opposing this kind of approach with a rule of competition, it should be encouraged in the name of a rule of solidarity. When German companies in the automotive, steel and chemical industries join forces to obtain supplies, how can it be claimed that they are infringing on competition? I regret that this kind of alliance does not take place in France. Allow me to evoke a very significant personal memory in this regard. I had the opportunity to talk to French automobile companies to sell them long-term PGM’s contracts. The dialogue lasted between ten and fifteen years, with no results. In two hours – twice an hour! -I convinced a German car company of the interest of such a contract.

Emmanuel Le Roy Ladurie: Isn’t one of your central ideas that mines have a negative image in French culture?

Answer:The widespread idea in France, in uninformed circles, is that a mine is dirty and polluting, whereas today a mine can be carbo-positive, i.e. it can consume more carbon than it emits. A perfect illustration of the incomprehension of what these activities are is given to us by the French refusal not to extract shale gas, but simply to drill to see if there is any, to explore. Furthermore, I believe that it is desirable to produce metals in our country under strict environmental conditions, rather than continuing to consume these same metals in our everyday products while remaining blind to the distant, sometimes degraded and sometimes polluting production conditions.

Jean-Claude Trichet: You make two criticisms: firstly, the French do not explore the French subsoil; secondly, they do not have global multinationals in the mining sector. On the second point, I would point out that our country cannot necessarily have multinationals in all areas. If we compare France to Germany, Italy and even England, we find an over-representation of global multinationals in the industrial field and an under-representation of small and medium-sized enterprises. In a similar vein to that of geological exploration limited to only 100 meters, I recently learned that in France, dramatic avalanches are only considered over the last hundred years, whereas in Switzerland, Austria or Germany, statistics cover the last three hundred years. It therefore appears that our country is apparently showing real negligence in areas that are nonetheless important. In addition, can you give us some details on the liquidation of French strategic stocks? On renewable energies in general, the most convincing argument I have heard is that investments in renewable energies are currently unprofitable, but that they will one day become profitable thanks to advances in technology; therefore, we would have to invest massively and exclusively in research and development to be present in these new technologies when they are ripe. What is your opinion on this? I understand that you are in favour of nuclear power. Can you give us the reasons why?

Answer:I regret that we don’t have multinationals in the mining field, we have many assets and I don’t think we can talk about neglecting our limited geological horizon. In fact, when we did some surveying, we looked for some things and not others. As a result, we didn’t have to go down to great depths. The V representing the axes Brittany, Massif-Central and Vosges could be a V of victorious geological discoveries.

As far as strategic stocks are concerned, I experienced first-hand what was happening. When I was at the Comptoir-Lyon-Alemand-Louyot in the late 1980s and early 1990s, I received a weekly telex from the GIRM offering at auction stocks of precious metals, palladium and platinum, among others. And I noticed that my competitors for the purchase of these metals were usually Anglo-Saxon banks that were buying for resale.

I don’t know if renewable energies are or will be profitable. This is not my area of expertise. On the other hand, I do know that they need so-called strategic or critical metals and that they are not mature, which means that on the one hand, unit quantities must be reduced – reducing thin layers when it comes to solar or reducing rare earths in wind turbines – in order to have an acceptable cost of raw materials and, at the same time, increase the energy efficiency of the devices. I believe more in the potential of solar than wind for the reasons given in my presentation. Finally, I would prefer the construction of renewable energies with metals that are as much as possible produced under good conditions in France and that would therefore travel as little as possible around the planet.

Am I for nuclear power? Yes, absolutely. I’ve written it many times in the newspaper Les Echos, which has earned me reprimands from certain individuals. It’s difficult to understand the hysteria that, in France, seizes certain minds as soon as one expresses oneself on nuclear power without condemning it. I am against the bipolar, with or without it, but for the multipolar, with nuclear power and with competitive renewable energies. This is why, in my opinion, the future of nuclear energy lies in nuclear energy itself. I add that, after speaking at a conference at the UN with Carlo Rubbia, Nobel Prize in Physics 1984, and after having had discussions with researchers from the Laboratory of Subatomic Physics and Cosmology of Grenoble (LPSC), I was convinced that considerable progress was possible in nuclear energy (see my article “Le thorium, nucléaire du futur” in Les Echos.

Bertrand Collomb: You are deploying a decline in the position of the engineer and coordinated technical thinking in our country. I’ve heard more often about an excess of power on the part of engineers, and particularly Polythechnic-Mining Engineers. If the French mining industry is far from being as successful as other branches of industry, it is probably because too much effort has been put into French mines, which were not really profitable. The very French way of always defending what is acquired, and that alone, has certainly weighed very heavily on the evolution of the mining industry. In France, do we have rare earths or strategic metals? And if so, don’t we face the same problem as other energy sources, which is that they are much more expensive to mine than to import from abroad? You said that French companies don’t have the idea of forming alliances with each other to go out and get the metals they need. It’s true that our companies have more confidence in the market and that they don’t consider mining exploration and exploitation to be part of their business. Today, there is a large concentration of rare earths in China, but if we fear a bottleneck situation, isn’t it because we haven’t yet prospected all possible deposits elsewhere? What about the rest of the potential reserves and the plasticity of the market, i.e. its ability to wait for new deposits to be discovered?

Answer:I have nothing against Polythechniciens-Mining Engineers, quite the contrary. I simply deplore the fact that, unlike Anglo-Saxon Mining Engineers, the most creative ones do not intend to work in the mines, but rather in financial services. I believe that in the field of mining, France could have done better. It has deposits and know-how; it has three banks which are the first in the financing of raw materials and which could have helped the mining sector if it had wished to acquire deposits abroad to exploit them, including the mines which were French discoveries. Are there deposits of strategic metals in France? Yes, there are deposits of major metals – copper, zinc – with their critical co-products as well as rare earths that could provide part of the needs of the country’s industry. In answer to your question on plasticity, a rare earth or strategic metal mine requires ten to twenty years of preparatory work to be exploited. But the industries using these elements do not have the time to wait ten to twenty years. Electric cars will be manufactured in China since the deposits are already being exploited there. France may not have enough rare earths unless it looks for them seriously. But in France, we don’t have the right to look for them. All mining drilling is subject to authorization and today, authorization is systematically refused. This is sadly seen with the experience of exploratory drilling for shale gas.

Should French companies have become more vertical? When they trust the market, they put up with it when it is temporarily under stress – and sometimes the temporary can be tenacious. All that remains is to buy cheaper than the competitor and at that point upstream integration is an advantage. When I was successfully selling precious metals to Japanese companies, particularly in the automotive industry, and at the same time I was only recording failures in France, I naturally wondered what was the point, until I realized that these Asian groups were investing in platinum groups in South Africa. Chinese and Korean companies had the same reasoning for other matters. Another example of verticality is provided by the world of steel; the latest movement of EDF with respect to the uranium mines of Areva is in conformity with this axis; it is normal, it is the only French strategic metal that conforms to the definition of my presentation. I explained it to you in June 2011 in a short article available for free in Les Échos(“EDF doit sauver les mines d’Areva“. The approach to raw materials is very different between the mindset that anticipates the risks of commodity shortages and that which only manages a price risk.

Marcel Boiteux: You told us that we have not been able to exploit the resources of our subsoil or to create the necessary companies on a sustainable basis, whereas in Australia, for example, large mining companies have developed which have spread all over the world. Why is it that these companies did not come to France during this spin-off? Were our deposits too expensive for what we could get from them – which would explain why they were abandoned – or was it for another reason, but which one?

Answer: Here’s a scoop: the very dynamic company that is currently filing exploration applications in France is Australian. But it is being forced to wait a long time for an answer, because few people understand mining exploration; the administration, politicians, media and ill-informed public opinion confuse exploration and exploitation and consider that mines in France are dangerous, polluting and ultimately useless.