Wartime or not, commodities producers still need their customers as much as the other way around

In Le Monde 15/04/2022 (Absolute version)

Not a day goes by without, as a boomerang of sanctions against Russia, anxiety-provoking statements pointing to a future « metal war », a shortage of « rare metals » that would hit our industries. World stocks are indeed already low due to the post-pandemic recovery and while Ukraine, which accounts for about 9% of European steel imports (in 2021) and exports iron and ferro-alloys, is seeing its logistical infrastructure and some of its metallurgical and mining capacities pulverized by the bombs. This « pro-scarcity » choir, a veritable fifth column undermining our will to fight, hopes that what a sanction has done, a cancellation of the sanction will undo. But it would be necessary beforehand that great changes take place at the head of Russia…

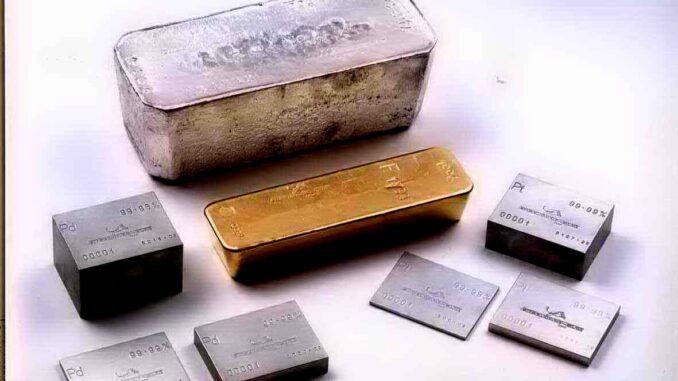

In reality, wartime or not, producers of raw materials always need their customers as much as the other way around. The West therefore sanctions according to its interests: the United States’ electricity production depends to the tune of 20% on Russian uranium, Russian gas is indispensable to Europe, Russian nickel or palladium are essential to both. So far, none of these are affected by the sanctions. Russian logistics, factories and mines are intact, few physical deliveries of Russian metals are missing, with the exception of products from the aluminum and steel industries and the indirect effects of self-sanctions on sea freight and transport insurance.

Moreover, there is no such thing as « rare metals », this concept has never been defined, neither scientifically nor geologically nor by market elements. It is only a very French, pro-oil and anti-electric car alarming fake-news that crystallized by making its first victims among statesmen. Unmasked by the success of electric vehicle, it nevertheless continues in its support for deep-sea mining under the pretext that « the clean exploitation of offshore hydrocarbons would justify the exploitation of deep-sea mines », whereas the impact on biodiversity of the exploitation of hydrothermal mounds or deep-sea nodules is unknown, uncontrolled and therefore incompatible with a responsible exploitation. Without going into detail about the safety of these mining vessels in time of war, the fight against carbon does not justify a remedy that is worse than the desease, and many corporates forbid themselves to use such production. Another néantise would be the « don’t look up » and the exploitation of extraterrestrial minerals, in the medium term, it offers no financial, technical or bio-environmental solution and we already know the end of the film.

In a real war, there are no longer any abundant « large metals » or critical « small metals », since all are strategic. And, there are several tools to mitigate possible shortages, if there is the political will to activate them.

First, prices can be regulated. Tsingshan, the world’s largest nickel producer, used derivatives to forward sell its future production increase on the London Metal Exchange. Investors bought its positions, ensuring liquidity in the market. But between February 24 and March 8, 2022, the black swan of the Russian invasion, speculation and panic quadrupled nickel prices, with little connection to market fundamentals – supply, demand, production costs. Sellers were faced with abysmal losses, investment funds with colossal profits. With the risk of a systemic financial crisis added to the war in Ukraine, the LME simply cancelled the March 8 prices. The control of an excessive price by eliminating the obstacle, in this case the investor, is common in war economies, just as excessive prices of other metals, energy or agricultural products are regulated.

The second tool is the substitution-ecodesign-recycling trio. Because it is a battery manufacturer and not an automobile manufacturer, Tesla knows that 65% of nickel production, a metal exported in particular from Russia and a major component of battery cathodes along with cobalt, is captured by stainless steel production. As a result, Tesla has been replacing nickel and cobalt in its batteries with iron for two years. It is already able to equip up to 70% of its cars with this abundant metallurgy…but manufactured in China. Given its lead, Tesla may be building half of the 100 million electric vehicles sold worldwide each year in 30 years. If 70% or more carry iron rather than nickel batteries, there will be even less of a shortage of the metal as other Chinese innovations are already substituting profuse sodium for lithium, pending other more abundant and efficient materials, such as sulphur cathodes. Ecodesign, which facilitates the recycling of metals ad infinitum and profitably, will support the whole process. Europe is committed to the battery industry, but it is leaving the leadership of these alternative solutions to Asia – to China in particular, whereas a war economy should give priority to these alternative innovations.

The third tool is the constitution of strategic stocks. In France, this would require a concerted effort by a strategic State aware of its dependencies and clear-sighted indutries, and a real Ministry of Planning to decide who finances them, who uses them and in what circumstances. Building from scratch such a stock of sovereignty for the long term while navigating at sight in the speculative short term will be complicated, because the government and the administration have neither the understanding nor the financial or human resources to manage it. Only a few corporates are building stocks, provided their boards are willing to create and manage them.

The fourth tool is to revive national production. On March 31, Washington activated the Defense Production Act, designed to encourage domestic production of materials used for batteries of electric vehicles. France could also adopt a mining and metallurgy doctrine and dare to responsibly exploit its metropolitan deposits of tungsten, titanium, lithium, tin, antimony, copper… And resurrect its metallurgy of strategic metals, whose deindustrialization has founded colossal fortunes, such as that of the metallurgist Comptoir-Lyon-Alemand-Louyot, whose last known owner was Fimalac. Such a war economy on a European scale could aim at a mining independence of about 50%, against 5% at present.

The Russian invasion has not triggered any real shortage. But, in the longer term, without finances, without technologies, without partners, Russia will become a comodities random and marginalized producer. But its exile can be erased if we trade the current conformism for metallurgical and mining dynamism. This has not been thought of or done, at any time, for over forty years. The time has come to eliminate this French industrial curse.