In La Tribune 05/10/2023

What the opponents of climate change, of the merits of the energy transition and of its emblem, the electric vehicle (EV), have never understood is that they have judged, and still judge, the proposed solutions in a static way. They resemble anti-nuclear activists before they were turned around like a spy, or the consumers of the 1990s who judged mobile phones negatively because they were too big, too heavy, had no autonomy and no network available throughout the country, whereas today we are equipped with phones that are small, light, with 5G, multi-functional and sometimes foldable.

This stubborn refusal to embrace progress that will save the day, and help control climate change, refutes the notion that the EV of 2023 will be to tomorrow’s electric mobility what the Ford T of 1908 was to today’s IC vehicles.

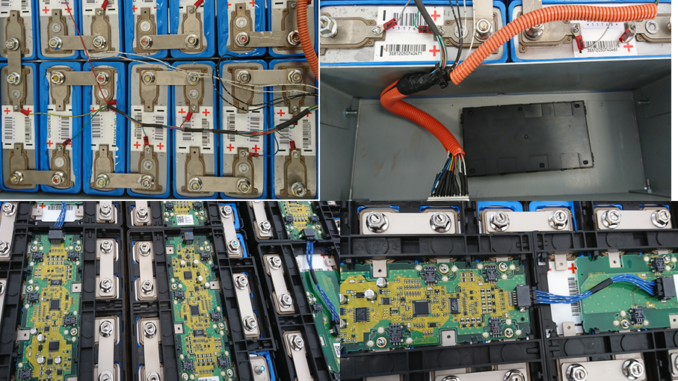

A schism caused by two battery models

The casuistry of the car and the syncretism of batteries are far from over, because the world of cars is now experiencing a schism. Two worlds are living side by side. The first, announced on 21 September 2021, has fully adopted the work of the CNRS, i.e. Lithium Iron Phosphate (LFP) batteries that do not catch fire. The second, still clinging to the less safe Nickel Manganese Cobalt (NMC) batteries.

The first is China and, more recently, Europe, where EV sales have exploded over the last ten years. The second is the world of delays, illustrated in particular by strikes in US car factories.

There is also a disconnect between the first, which is committed to new battery materials to reduce the risks of sovereignty and lower costs for the consumer. While the latter is highlighting the tax benefits of the Inflation Reduction Act (IRA)… while ignoring its inflationary effects.

Schism. The former is repatriating production lines via the opening up of globalisation, with Korean and Chinese battery and car manufacturing plants setting up in Europe. The second aims to repatriate production lines via tax breaks.

Disunity. The first is global and competitive, and therefore deflationary, since there is already an overproduction of batteries in China, which means that manufacturers’ margins are being squeezed and prices have fallen by 30%. The second will be based on national preference and subsidies.

The former will exercise sovereignty over the world, the latter over its own territory.

Tesla, the elephant in the room

The elephant in the room is still Tesla. It’s an American company, but it’s an inventor and forerunner that benefits from technical and financial progress in Asia, Europe and the United States, because it’s first in everything. It consumes both batteries and eliminates rare earths from its engines.

As a result, the EV market is constantly adapting and growing. But at different speeds, as the latest penetration rates illustrate: 30% of EVs in the 8 major European markets, notably Germany, China is at 37% and, as usual in this market, the United States is lagging behind, at over 10%. By 2035, these figures will be 100%, 80% and 70% respectively.

This is why the future market shares of electric car brands, which were predicted 25 years ahead at 50% for Tesla and 50% for Chinese cars, have shifted to 40% Tesla, 40% China and 20% Europe. These ratios are in fact changing and rebalancing in line with European progress.

Naturally, before they give way to future materials that are not yet in the media spotlight, the prices of the metals used in today’s batteries are impacted by these decouplings.

Lithium prices have been divided by almost four since the speculative peak in November 2022. The lithium war has not taken place, and mining supply is increasing not only in terms of volume, but also in terms of countries of origin. Australia and South America are no longer alone in the driving seat. Europe, Africa and China are also producing.

Nickel prices have plummeted and fallen by more than a factor of five since the “rare metals” swindle. Nickel miners know who was behind it and who was responsible for it, so it will have been fatal to the global use of the metal in batteries. Electric mobility will not be nickel’s Eldorado; stainless steel remains its destiny.

The “rare metals” conspiracy trap has also closed on cobalt prices. They are back to where they were ten years ago. Abandoned by the world of car batteries, there is little chance of the Congolese metal regaining a strong speculative foothold.

Finally, contrary to the rumours spread by the pro-oil, or even pro-brown coal counter-currents, recycling of these metals or other battery materials is already a reality.

The lure of the hydrogen car

Hydrogen-powered light vehicle, on the other hand, remain an illusion. This type of propulsion for LV is much less efficient than batteries, because it consumes more electricity per kilometre. On the other hand, it is ideal for heavy transport: lorries, railways and boats.

As Ernest Renan said: “Nothing lasts like truth. Everything that serves it is preserved like a small but acquired capital; nothing in its little treasure is lost. What is false, on the contrary, crumbles. The false does not melt, while the little edifice of truth is made of steel and always rises. That’s how it is, and it’s also true for the EV, the price of which has been falling steadily for ten years and will continue to do so.

Coal was the energy of the 19th century, oil and gas were the energy of the 20th century, and electricity is now our energy in the 21st century. By 2023, we have all the technologies we need to produce enough nuclear and renewable electricity, and to ensure 100% electric consumption in all sectors. All of this will be accompanied not only by a deflationary effect for European consumers of 50% compared with the same hydrocarbon vectors today, but also by a reindustrialisation of all kinds: electric mobility, electric storage, heat pumps, carbon capture and storage, etc. All of this is already and will continue to be the case in the future. All of these are already and will be even more virtuous for the climate.

So the question we should be asking ourselves is how much electrical energy do we need and want to produce. This is an existential question in terms of “how much”, but also “to do what”. The answer calls for a broad consensus and a plan in the midst of a desire for sovereignty. This last positive aspect is, for the moment, an essential guide and the powerful driving force of our future.